Scroll through all the updates to get to my original post.

The latest update is HERE.

The FBI has seized his fancy cars – an Aston Martin Virage and Bentley Continental.

Breaking: SEC sues Chris Faulkner aka Frack Master Fraud of Breitling Energy

Another update: Chris Faulkner of Breitling Energy aka Frack Master sued me.

The unsubstantiated rumor is (as of late May): The Frack Master has been locked out of his offices for failure to pay rent and hasn’t paid his employees since January. I get email from people saying he owes them money. According to an email, the FBI and IRS came in early May and downloaded all computer data and then removed all the hard drives. This is not a surprise to me because they left a footprint here along with SEC, DOJ and Federal Trade something-or-other. Still, FOX News had him on Varney’s show in late May. SMH. If you want to know where Frack Master is, check out the Reaper 24/7 on Breitling’s message board, it’s occasionally entertaining. Poster known as FMII used to comment here. He has done a quite a bit of research on the Frack Master.

UPDATE: The April 2015 edition of Texas Observer has a devastating profile of Chris Faulkner aka Frack Master. READ IT

Highlights:

- He enrolled at SMU in 1995 but never graduated. His tenure there ended in a lawsuit in which he accused a chemistry professor of defamation for accusing him of violating the honor code and demanded $69 million.

- His $290,000 Cabo San Lucas wedding was featured on Season 3, Episode 2 of Platinum Weddings.

- Records filed with the Texas Secretary of State list Faulkner and his wife as founding officers of BigVideos.com LLC (BigVideos.com once carried the “best selection of high-quality adult DVD movies, anime, hentai, fetish and gay titles”) and Porn Toys Corp., which is self explanatory.

- He has claimed to have an honorary doctorate from Concordia College in California, a degree the college has no record of.

- Faulkner has filed for trademarks on the names “Frack Master,” “Frackmaster,” and “Frackman.”

- Don’t miss the part about porn movies, sex toys and poseable Frack Master toys.

An incomplete list of new lawsuits. Details available here.

Super interesting read:

Christopher Faulkner, Plaintiff

V.

Sharon Wilson, Defendant

DC-15-04690

Please note: 9/22/2015 Motion to Withdraw as Counci

which can happen if you don’t pay your attorney

Another super interesting read that might require highlighters:

The Ann L. Stephenson Group

d/b/a/ Stephenson Group, Payperclip

V.

CHRISTOPHER FAULKNER

d/b/a § BREITLING OIL & GAS

BREITLING OIL & GAS CORP

BREITLING ENERGY CORPORATION

and RICK HOOVER

DC-15-07063

And another one:

OilPrice.com

V.

BREITLING ENERGY CORPORATION

PATRIOT ENERGY

CHRISTOPHER FAULKNER

and MICHAEL MILLER

DC-15-11841

And another one.

Supreme Court of the State of New York

Status Luxury LLC

V

Breitling Oil & Gas Corp.

Breitling Energy Corp. and

Christopher Faulkner

Breitling’s attorney in this case withdrew for nonpayment.

CC-15-03934-D – HART ENERGY PUBLISHING, LLLP

vs.

BREITLING ENERGY CORPORATION

NOTICE OF DEFAULT JUDGMENT

CAUSE NO. CC-15-03934-D

CC-15-04586-E – RALSTON OUTDOOR ADVERTISING LTD.

vs.

BREITLING ENERGY COMPANIES, INC., BREITLING ENERGY CORPORATION

CC-15-02820-E – IHEART MEDIA, INC.

vs.

BREITLING ENERGY CORPORATION

There are others…

Original blog post starts here:

And suddenly there was Chris Faulkner.

He just appeared oozed like an oily fog without the little cat feet onto the fracking scene. Who is he and where did he come from were questions asked. Real oil men don’t just materialize, they are bred and raised or, at least, groomed.

The Internet host entrepreneur:

The Caterpillar sent me to Google where I learned from Rip Off Report that Faulkner owned CI Host, a web hosting company that is generally not held in high regard. There is something about not paying for marketing merchandise and something else about a lawsuit for damaging a house he leased. The damage was assessed at $18,498.00 and $658 to clean the yard. (Good heavens! How dirty would a yard be to cost that much to clean.) Faulkner appealed the trial court decision but it was upheld under appeal.

In another dust-up, a federal judge ordered CI Host to remove “public service announcements.”

Following an order from a federal judge in Dallas last week, CI Host, one of the nation’s largest Web-hosting companies, has removed several online “public service announcements” it posted about purported fraud by Go2Net. com, one of the largest Internet search engines, court documents say.

The article says this was only one of several lawsuits against CI Host who reportedly couldn’t post a financial bond so the winners of the lawsuits may have been SOL.

Another article says Microsoft is suing CI Host but that was settled. And another where Faulkner sued for defamation but the judge dismissed the case and made Faulkner pay the court costs.

You can read reviews about CI Host and Faulkner HERE. If you scroll down and down you will not find one person with a nice thing to say.

The CI Host Google trail is endless. According to a Star-Telegram article, CI Host was “mired in dozens of lawsuits” by 2004 and shut down in 2009.

The Oil Man:

From Faulkner’s new bio we learn that he has

Sha-zam! That’s extensive, y’all!

It’s unclear to me how Faulkner gained all the extensive experience in oil and gas while running an internet hosting service and dodging lawsuits until 2009.

The Star-Telegram is equally unclear on this:

The Star-Telegram is equally unclear on this:

According to Breitling, Faulkner, 37, founded the company in 2004, although records with the Texas Secretary of State and the U.S. Securities and Exchange Commission show various related Breitling entities registered in 2009 and later.

In a prepared release written on January 22, 2014, to announce that Faulkner’s company, Breitling Energy was going public (more on that further down), Faulkner says:

In a prepared release, Faulkner said Wednesday was “an exciting day for Breitling,” which he said has “a decade of successful growth.”

More muddy stuff about Faulkner and his sudden emergence as an oil man is how, on one hand, he talks about his technical expertise with a drill-bit…

The Company’s dual-focused growth strategy primarily relies on leveraging management’s technical and operations expertise to grow through the drill-bit, while also growing its base of non-operating working interests and royalty interests. LINK

…yet, on the other hand, he told Reuters in an interview…

In an interview with Reuters last year, Faulkner said the company prefers to be a non-operating partner.

That’s okay. I can remember when one of my boys couldn’t decide between being a dentist or a secret agent when asked what he wanted to be when he grew up. So he finally settled on a “secret agent dentist.” Maybe Chris will decide soon before too many people get hurt.

The Star-Telegram couldn’t find much on Breitling production listed on the Texas Railroad Commission site.

Information on Breitling’s wells in Texas is sketchy. The company is not listed as a well operator within the state in Texas Railroad Commission records. Star-Telegram

We have asked him many times where his wells are located and if it’s possible to visit the locations, but there has been no answer to date. But we have a savant who can jockey the RRC site and here’s what we found:

In order to be an operator and “grow through the drill-bit” with the State of Texas, you have to file a P-5.

Faulkner’s organization numbers with the RRC are:

- 090731 – Breitling Oil and Gas Corp – Initial P-5 File Date for 090731 is January 6, 2010.

- 090727 – BREITLING OPERATING CORPORATION – Initial P-5 File Date for 090727 is October 9, 2014

No wells are showing for the operator #090727 ~ Breitling Operating Corporation.

There is one well: for the operator 090731 ~ Breitling Oil and Gas Corp.: Lease Name: TEAFF, Lease No.: 31475, API No.: #44134434. The permit for the TEAFF indicates it is a VERTICAL well not a horizontal. The depth is 6000′ and the total volume is 4,588 bbls.

Faulkner claims to have been organized since 2004 as Breitling Energy, yet he did not filed a P-5 with the Texas RRC as Breitling Oil and Gas Corp until January 6, 2010.

As promised earlier:

The Star-Telegram article was written in response to the news that Breitling Energy was going public. The Star-Telegram gave some strong hints that the deal was fishy but they didn’t tell readers that it was a reverse merger [sound effect], which is a very important detail for investors. (The Dallas Business Journal and The Oil and Gas Financial Journal also failed to mention the reverse merger [sound effect].

In 2011, the Securities Exchange Commission SEC issued a WARNING to stockholders about reverse mergers [sound effect]:

The U.S. Securities and Exchange Commission cautioned investors about buying stakes in companies that gain listings on U.S. exchanges through so-called reverse mergers [sound effect], saying they may be prone to “fraud and other abuses.”

Many of the companies, often overseas operations that access U.S. markets by acquiring publicly traded firms with few or no operations, “either fail or struggle to remain viable” and may use small audit firms that don’t verify financial statements, the SEC said today in an investor bulletin.

I don’t know much about the stock market and reverse mergers [sound effect], but I think when your overall evaluation says, “BAD” it’s a sign that investors should have listened to the SEC WARNING.

larger version HERE

larger version HERE

But I’m not done yet.

Here is where it starts getting REALLY fishy:

In this reverse merger [sound effect], Breitling Energy (a private company) acquired Bering Exploration, Inc. (a publicly-held company).

As of December 9, 2013, Bering Exploration, Inc. was acquired by Breitling Oil and Gas Corporation, in a reverse merger [sound effect] transaction. Bering Exploration, Inc. engages in the exploration, acquisition, development, production, and sale of natural gas, crude oil, and natural gas liquids in the United States. It owns interests in various projects located in the Caldwell County, Victoria County,and DeWitt County in Texas; in the Beauregard Parish and Jefferson Davis Parish in Louisiana; and in South Texas.

Who the hell is Bering Exploration, Inc. I asked The Caterpiller who again sent me to Google.

Bering Exploration, Inc., formerly Oncolin Therapeutics, Inc., (OTCBB: OCOL) announced today that it has acquired an interest in a South Texas oil and gas prospect that has potential gross reserves of 5,000,000 barrels of oil and 46 BCF of natural gas. The initial well will be drilled to approximately 10,000 feet to test the Oligocene Frio trend in South Chambers County, Texas. Bering’s interest is a 5% working interest after pay out in this prospect. LINK

And who is Oncolin Therapeutics, Inc.?

Oncolin’s robust pipeline of oncology research programs are funded primarily by peer-reviewed Federal grants.

You can do that–just one day a federally funded oncology company decides to be an oil and gas exploration company? And that’s okay? This does explain where Faulkner got the production he talks about. But that happened at the end of 2013, just to be clear about his vast experience and all.

I noticed that Oncolin Therapeutics issued a disclaimer on their press releases called “Safe Harbor Statement.” And a disclaimer is on the Bering Exploration reverse merger [sound effect], press releases only this one has oil and gas where the Oncolin disclaimer was about therapy results.

Certain statements in this news release regarding future expectations, access to public capital markets, plans for acquisitions and dispositions, oil and gas reserves, exploration, development, production and pricing may be regarded as “forward-looking statements” within the meaning of the Securities Litigation Reform Act. They are subject to various risks, such as operating hazards, drilling risks, the inherent uncertainties in interpreting engineering data relating to underground accumulations of oil and gas, as well as other risks discussed in detail in the Company’s periodic reports and other documents filed with the SEC. Actual results may vary materially.

Any number of factors could cause actual results to differ materially from those in the forward-looking statements, including, but not limited to, the volatility of oil and gas prices, the costs and results of drilling and operations, the timing of production, mechanical and other inherent risks associated with oil and gas production, weather, the availability of drilling equipment, changes in interest rates, litigation, uncertainties about reserve estimates, environmental risks and other risks and uncertainties set forth in Company’s periodic reports and other documents filed with the SEC. The Company undertakes no obligation to publicly update or revise any forward-looking statements.

Dear Readers,

Please do not ask me to make sense of this for you because I can’t wrap my head around how a federally funded oncology research company suddenly becomes an oil and gas exploration company. Or how an Internet guy can suddenly proclaim himself an oil man expert and no one questions that.

Except, it starts to make some sense why the frackers suck so bad at fracking.

What is clear to me is that Chris Faulkner is not a real oil man and has little to no experience using his “drill-bit” or fracking in the oil and gas patch.

What is not clear to me is why journalists continue to defer to him as if he were some kind of expert. Fer crine out loud! Here is a list of resources for journalists, prepared by a serious journalist who would never quote someone like Faulkner. HF2.0Primer. Use it!

Your friend,

TXS

Addendum:

More random information about Chris Faulkner:

I also found many instances where Faulkner claims to have production in certain states, and even countries, but as you flip through the Internet, those locations vary wildly.

Faulkner’s pro-fracking newspaper ad was banned by Advertising Standards Authority because it was found deceptive. (Imagine that.) Here is the ASA adjudication.This happened in the UK, of course. The U.S. has not ASA.

Heard in the Denton City Council Chambers when Faulkner asked the mayor and council members if he could come to the table and negotiate a solution: If you bring this guy “to the table” be sure it’s chained down. He is so shady there was a fog following him around.

From our friends in PA who ran up against Mr. Faulkner.

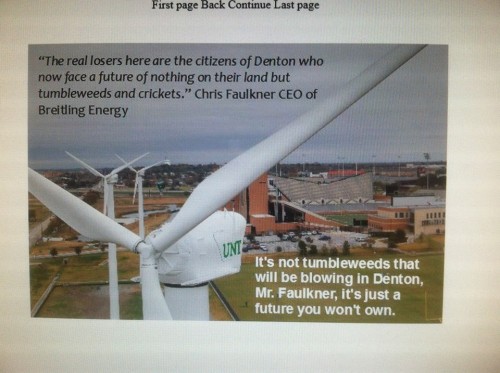

Petulance after Faulkner was embarrassed in UK because of the Denton fracking ban

The Message from Dory Hippauf on Vimeo.

The word defamation follows this guy around like the word fraud. This recent lawsuit shows that Faulkner is still up to the same shenanigans. Stay classy.

Suits against Breitling Energy firm claim cybersquatting, defamation. Dallas Business Journal, Aug 5, 2011.

Two competitors of an Irving oil and gas investment corporation have filed lawsuits claiming that the company’s chief executive published defamatory information about them online after setting up websites containing variations of the competitors’ names.

Dallas-based Fusion Energy LLC claims in a lawsuit filed July 11 that Christopher Faulkner, CEO of Breitling Oil and Gas Corp., acquired the websites fusionoilandgas.com and fusionoilandgas.blogspot.com, then began publishing “defamatory, false, and malicious information” about Fusion and its president and CEO, William Scott Court.

And additional information supplied by a commenter on DailyKos.

More stuff on the intertubz–

In January 2013, the former Bering Exploration was the subject of a glossy mailer with a doctored photo combining the faces of President Obama and former Secretary of State Hillary Clinton, saying investors who don’t like the administration’s energy policy should invest in Bering.The advertisement in “The Wall Street Revelator” was headlined: “A Guide To Profiting From The Hill-Bama Energy Strategy.” Below that in red letters it further read: “BERX Has JACKPOT Potential. It Could Lead You To Rapidly Turn $10,000 Into $195,333.”

And this gem:

Fracking fluid is safe to drink! http://t.co/WIKdwaNKuU

— FrackMaster (@Frack_Master) November 27, 2014

Safe Harbor Statement:

This blog post contains statements that may constitute forward-looking statements. These statements are based on relatively current internet searches and may involve a number of uncertainties and risks that could cause your actual mileage to vary. For additional information about the players future business dealings and financial results, consult The Caterpiller.

Bluedaze undertakes no obligation to update any forward-looking statement that may be made from time to time by or on behalf of Bluedaze, whether as a result of new information, future events, the availability of and use of the “drill-bit”, and other risks and uncertainties set forth here or anywhere in the whole wide world. Bluedaze undertakes no obligation to publicly update or revise any forward-looking statements but if I got something really, really wrong and you can prove it to The Caterpiller, I will strike through and make a correction.

The article that angered Faulkner to sue for defamation, yet again:

A mix-up in well names? No records found for wells Breitling says were drilled in North Dakota.

The district court judge ruled against Faulkner and charged him with way over $100k in attorneys fees. The decision seems to be under appeal. I took this from some of the court papers.

Awarding Yourself Awards

In the comments, “Tammy” notes:

They continue to receive countless awards from notable and reputable organizations

So I’m looking into these awards from “notable and reputable” organizations. On the Awards page of Breitling’s website I see Oil and Gas Awards mentioned most frequently.

Breitling was named a finalist for the 2015 Oil and Gas Awards. On the sponsorship/partners page for the Oil and Gas Awards, Breitling is named as a “Platinum Sponsor,” which is the highest level of sponsorship.

Faulkner received an award from AERG. The 2013 award that Faulkner received seems to be the only time awards were given. I can’t see that the website has been updated since 2013. The blog hasn’t been updated since October 12, 2012. Digging further, I find that Chris Faulkner is the CEO of AERG. I made a pdf incase this page disappears.

2/13/15: Breitling issued a press release today saying that Virgil Films will distribute Faulkner’s fracking documentary, Breaking Free. This from an email discussion explains how Faulkner continues his propaganda:

The press release attached to “Breaking Free” gives the “impression” that Robert DeNiro would be in favor of fracking the way it mentions where the film was shown (at the private screening room above DeNiro’s “chic” Tribeca restaurant)…clearly he’s not if he was working with Mark Ruffalo and Artists Against Fracking back in 2013.

***

Pump and Dump. PDF – I will need to spend some time sorting this out.

Interesting conversation in royalty owner forum

About Sharon Wilson

Sharon Wilson is considered a leading citizen expert on the impacts of shale oil and gas extraction. She is the go-to person whether it’s top EPA officials from D.C., national and international news networks, or residents facing the shock of eminent domain and the devastating environmental effects of natural gas development in their backyards.

- Web |

- More Posts(5121)

It seems like the deeper you dug on this Sharon the greater quantity of trash you expelled. Sounds typical for many with ties to the oil and gas industry, real or imagined.

Thanks for your continued vigilance on this issue.

Perhaps someone at KRLD has some answers; they sold out to him. http://www.breitlingenergy.com/breitling-energy-ceo-host-weekly-radio-talk-show/. Also, didn’t he say he lives in Southlake near wells? Um, not sure if he was talking about Southlake, TX, but there aren’t any oil/gas wells in Southlake.

I feel so stupid trusting he would help me get Chesapeake to use urban flowback tanks (the ventless ones)…here are the letters and the false promises he made .. https://barnettshalehell.wordpress.com/2014/09/03/chris-faulkner-all-money-and-no-power-broken-promises/

You were just hopeful and a little desperate and he took advantage of that. His company may hold a lot of royalty interests but, at least here in Texas where I can find the records, he has not done a lot of growing through using that there drill-bit.

Let’s see him spin this:

http://fuelfix.com/blog/2014/12/26/natural-gas-falls-below-3-in-latest-slide/

Natural gas falls below $3 in latest slide

HOUSTON — The benchmark future price for natural gas fell below $3.00 per million British thermal unit in trading on Friday, continuing a slide of about 30 percent over the last month.

Natural gas for February delivery traded down 1.25 percent to $2.99 per mmBtu on the New York Mercantile exchange early Friday, down from $4.00 on December and the next-month contract’s lowest price since 2012. The price would rally to close at $3.00. The slide follows a number of bearish signs for the heating fuel over the past week.

I got into investing a few years back – so I certainly can’t say I’m a pro at this – but I have been following several oil & gas companies, include Breitling Energy and there seems to be some discrepancies in the article. I also followed Breitling when they were Breitling Oil & Gas and thus far BECC has a bright future. They continue to receive countless awards from notable and reputable organizations that I am certain would question the contents of this article, as well. There has to be some reason why World FInance continues to award Breitling year after year. Take a look….

http://www.breitlingenergy.com/?s=awards

Here’s some other info. for your reading enjoyment:

1) http://www.entrepreneur.com/article/78420

2) http://www.thewhir.com/web-hosting-news/web-host-c-i-host-sells-shared-hosting-to-x7

As I mentioned, I have been following this guy (Chris Faulkner) for a while and there is some interesting stuff out there, but I tend to focus on the articles from the reputable & known sources….

Good luck with your investing there, Tammy.

As for as reputable sources, I used the Securities Exchange Commission, The Fort Worth Star Telegram, The Texas Railroad Commission, actual court documents, etc.

Compare that to a link to Faulkner’s own website, an article from 2005 and a 2009 article about Faulkner selling his own business. Man, I guess you are the winner in the reputable sources department.

BECC has a bright future as long as gullible, if not greedy, people with money continue to buy Faulkner’s snake oil.

Faulkner impresses me as that guy you see at Holiday Inn “This Weekend ONLY” holding one of those get rich quick seminars.

He’s one of those guys whose credibility and experience can’t hold up to even a few questions, and the whole thing comes unraveled like a cheap sweater.

Me too. The Whir. It’s the first thing I read in the morning and the last thing I read at night! Especially historical articles. It is definitely important to have due diligence with all your financial investments. Interesting that The FrackMaster was an oil man while he owned CI Host. It’s all amazing.

I just found this blog and I just wanted to say, thank you.

There is no public evidence that Chris Faulkner has ever had anything to do with a horizontal fractured well except to buy leases that led to miniscule interests in a handful of other companies’ wells. I must qualify the above by saying he appears to have drilled one well with a 500 ft lateral that was fractured and never produced, not the kind of well you would think of from the Frackmaster. He has drilled as operator four or five conventional wells, only one of which has produced. That well is the Teaf which is producing 10 bbls a day and has never averaged for a month over 30 bbls a day. This is the well that he estimated could make 160 bbls a day.

An interesting thing about the oil industry. It is conceivable for one to design, drill, fracture, and produce a well while keeping one’s name off public records, but why would one do that, particularly if one craves the public eye.

I assume this is from Texas. I couldn’t be sure what he might have in other states. He certainly hasn’t fracked the hundreds (or thousands) of wells like he has indicated in public comments.

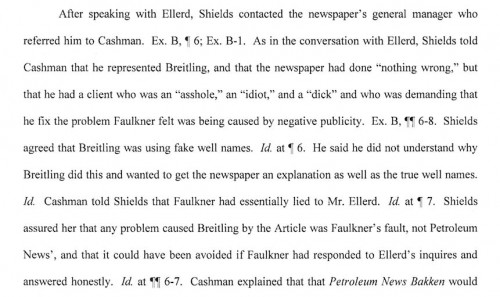

No, I checked the entire US. There are commercial services that collect well and production data for virtually the every state. In the past, he had listed on his webpage projects in the fashion that the industry lists wells, Operator-Lease Name, well number. While a well existed for each name, the names of the wells were not the same as the projects. He used Breitling where the operator name normally is and some made-up name where the well name normally is. I am virtually certain his interest in each well is tiny, by examining his reported proved producing reserves. This was the issue in the Lawsuit against Petroleum News Bakken. It aggravated him that the paper reported the truth. I believe you mentioned this lawsuit–he lost and got SLAPP’ed. The court documents are listed online in the District Court of Dallas County Cause No. DC-13-08494, an amusing read. By the way, that short little horizontal well he drilled, but never produced is in Kansas, if I remember correctly.

Insightful! Thank you so much. Each time I see an oped by him or an article quoting him, I drop this link in the comments. So your help keeping the information updated is appreciated.

I am convinced that Breitling has read a lot of posts similar to my first one. There have often been posts similar to Tammy’s above, vague references to BECC’s future, but having little substance. These might be sock puppets for Breitling employees. The company is web savvy as you might expect. Nowhere have I seen Breitling dispute what I have said. Seems like they would set the record straight, so to speak. Frankly, I am quite curious about the facts and would love to hear from Breitling.

I have looked into the companies that have given Breitling its awards. I’ll leave it to someone else to delve into that.

A reporter would like to speak with you to expose some of this. If you are interested, click on Contact and send me an email.

Sharon

Have the reporter contact me. I am an actual investor that was lied to. I actually met him in the field at one of his “drill” sites.

Faulkner created his empire by being a fake. he would go and creates websites/advertising saying he was the number one webhost in the country. He would male 20 or 30 of these websites so no matter when you searched for “best webhost” or “top rated webhost” all roads led to him.

Below is what I think probably happened. Breitling has gone to great lengths to make it impossible to confirm or disprove, so some of this is speculation. Breitling invites speculation as a publicly traded company.

Faulkner successfully convinced some people that he was drilling wells and developing technology. He ran a phone bank that cold called people to invest in royalty and leasehold properties. He takes management fees, overrides, and carried interests. He created the persona of “Frackmaster” convincing young journalists that industry used that moniker.

Now that he has established the “Frackmaster” persona, he is moving away from convincing people he is an industry technology leader and has moved the “retail” portion of his business to Crude Energy, which is making some fairly unbelievable claims like “spending two million dollars a year on research,” Leaving the reader to infer the research is into technology.

The question is not whether Breitling is making money, there is little doubt that, at least, the employees are making money. The question is, do his direct investors make money. Now that Breitling is publicly traded and he has established his persona, he is more transparent and says Breitling is well situated in a low price environment because they have no debt. This is undoubtedly true, because it is unlikely that Breitling has invested much money.

WCGasette, who has commented on this post, called my attention to Crude Energy a few weeks ago. WCGasette said that Crude Energy was the next FrackMaster. From what you suggest, that was only slightly off.

Another reader sent me Faulkner’s arrest record where he plead guilty for possession of a controlled substance. I don’t really care about such things. WCGasette thinks Faulkner would make an excellent presidential candidate. It seems he has all the attributes.

If you look into Crude Energy, look into Parker Hallam, you will probably find a long history of Parker and Chris, maybe start at Crude Energys address..

That’s correct. Yout can also say that about every employee at Crude Energy. They all worked for Breitling and are even located in the breitling office!

Breitling is at the center of an SEC investigation. You got something right!

How do you know this? Not that it’s surprising but I would like to substantiate.

First hand knowledge. We have not been told what the investigation is in regards to itself. Chris has been called to testify several times.

First hand knowledge. Breitling’s sole purpose of going public was to avoid the SEC investigation. So it may be regarding Breitling as a Private Company, rather then Public. Which would be of interest to those who invest in Crude Energy since Chris has a strong role(basically the CEO) in the operating of that company. You should look closely into Crude Energy it’s Breitling as a private company.

That makes sense. Thanks and please keep us updated. People aren’t commenting much but they are still reading the post.

This should also be of interest:

http://www.fbi.gov/dallas/press-releases/2011/dl012611.htm

The Rand’s were personal friends of Chris Faulkner. Just interesting how his friends went to prison for securities fraud in the oil and gas market, and then a couple of years later he jumps into the O&G business.

Also, not sure about the commenter “Tammy” as Chris’s wife’s name is “Tamra” but everyone always called her Tammy.

Interesting indeed. Nice circle of friends he has.

red – soon to be EX Wife.

March 4 2015

I investd in Breitling

March 4, 2015

March 4 2015

I investd in Breitling

March 4, 2015

I invested in Breitlings Jericho Property (501 wells in Texas and Louisiana) in 2012. I received my monthly check in mid February and deposited it on the 19th. On March 2 I received notice from my bank that the check had bounced because of non sufficient funds. The statement shows that gross revenue for the month was $213,342.29. I have attempted to call but only got an answering service. Messages were left but there has been no reply. The check was signed by Chris Faulkner. I wonder who has my money.

Would you like to speak with a journalist? If you give me permission, I will forward your contact information. I am very sorry to hear this has happened to you.

Noticed Breitling had a change in their CFO? Does anyone know what happened?

Breitling has again nominated itself for a prestigious award. Faulkner is setting up the argument that all criticism is the result of being outspoken and socially responsible.

http://www.businesswire.com/news/home/20150318005244/en/Breitling-Energy-Nominated-Prestigious-Social-Responsibility-Award#.VRGDfvnF-68

Isn’t that precious.

My story on Faulkner is out in the Texas Observer. Story not yet online but magazine available in finer newsstands. http://www.texasobserver.org/issues/april-2015/

I clicked on your link and there wasn’t anything to read? CRUDE ENERGY has completely disappeared from the Internet. Also, chris has bought and started a NEW oil and gas company using ALL of crude energy employees except parker hallam.

Chris faulkner new oil and gas company since he tanked crude energy

http://www.patriotenergy.com/newsroom/